plans trust texaswagnerbloomberg play a significant role in financial security and estate planning. In Texas, Wagner Bloomberg has emerged as a key entity in managing such plans efficiently.

Understanding Texas trust laws is crucial for individuals and businesses looking to protect their assets. Wagner Bloomberg provides tailored solutions that align with state regulations and individual needs. Their expertise ensures compliance while maximizing benefits for trust holders.

Whether planning for future generations or safeguarding wealth, choosing the right trust strategy is essential.

What is a Trust in Texas?

A trust is a legal arrangement in which a trustee holds and manages assets on behalf of beneficiaries according to the trust’s terms. This arrangement ensures that assets are distributed according to the grantor’s wishes while offering benefits such as probate avoidance and asset protection.

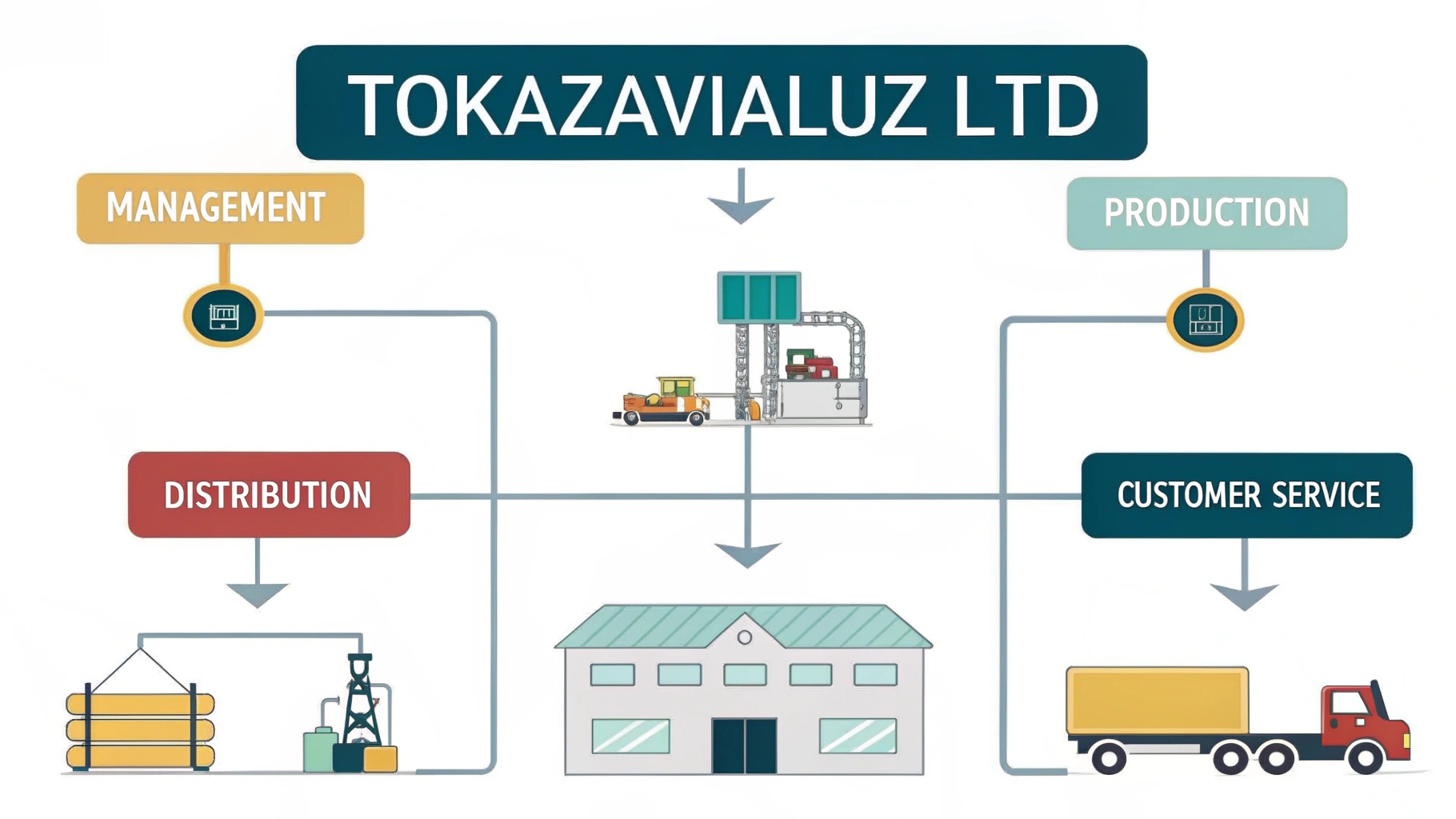

How Does a Wagner Bloomberg Trust Work?

Wagner Bloomberg provides customized trust services that help individuals and families protect their wealth and manage estate planning efficiently. Their trust structures ensure compliance with Texas laws, allowing for asset protection, tax efficiency, and seamless transfer of wealth to future generations.

What Are the Benefits of Creating a Trust in Texas?

Creating a trust in Texas offers numerous advantages, including asset protection from creditors, avoidance of probate, controlled wealth distribution, and potential tax benefits. Trusts also provide privacy and ensure that beneficiaries receive assets according to the grantor’s specific instructions without court involvement.

What Types of Trusts Are Available in Texas?

Texas recognizes various types of trusts, including revocable trusts, which allow modifications, and irrevocable trusts, which provide strong asset protection. Other options include special needs trusts for disabled individuals, charitable trusts for philanthropic purposes, and testamentary trusts, which take effect after death.

Is a Trust Better Than a Will in Texas?

A trust can be more beneficial than a will because it avoids probate, maintains privacy, and provides ongoing asset management. In contrast, a will must go through probate court, which can be time-consuming and costly. However, the best option depends on an individual’s financial situation and estate planning goals.

How Do Wagner Bloomberg Trusts Help in Estate Planning?

Wagner Bloomberg trusts provide expert legal and financial guidance to individuals seeking to manage and protect their estates. Their trust structures help minimize estate taxes, avoid probate, and ensure smooth wealth transfer while offering professional trustee services to oversee and manage assets effectively.

Are Texas Trusts Subject to Estate Taxes?

Texas does not impose state estate taxes, but federal estate tax laws may still apply to estates exceeding federal exemption limits. Proper trust planning can help reduce or eliminate estate tax burdens, ensuring that more assets are passed on to beneficiaries.

Who Can Be a Trustee in Texas?

A trustee in Texas can be an individual, such as a trusted family member or friend, or a professional entity like a bank or a trust company, including Wagner Bloomberg. Trustees must act in the best interests of the beneficiaries and follow the terms of the trust agreement.

Read more:

Faygie Skaist – Nutrition Counselor and Wellness Advocate https://speedyshortt.com/faygie-skaist/

Can a Trust Be Modified in Texas?

Revocable trusts can be modified or revoked by the grantor at any time, offering flexibility in estate planning. However, irrevocable trusts generally cannot be changed unless exceptional circumstances arise, such as court approval or beneficiary consent under Texas law.

How Long Does a Trust Last in Texas?

A trust in Texas can last indefinitely if structured correctly, such as dynasty trusts that benefit multiple generations. However, some trusts have termination dates based on specific conditions, such as when a beneficiary reaches a certain age or upon the occurrence of an event.

Do Trusts Protect Assets from Creditors in Texas?

Irrevocable trusts in Texas provide strong asset protection since the grantor relinquishes ownership of the assets. In contrast, revocable trusts do not shield assets from creditors because the grantor retains control over them. Proper trust structuring is essential for legal protection.

What Is a Special Needs Trust?

A special needs trust is designed to provide financial support for a disabled individual while preserving their eligibility for government benefits such as Medicaid and Supplemental Security Income (SSI). These trusts ensure that funds are used for the beneficiary’s supplemental needs without affecting assistance programs.

Can I Create a Trust Without an Attorney in Texas?

While it is possible to create a trust without an attorney, legal guidance ensures compliance with Texas trust laws and prevents costly mistakes. Professional assistance helps customize the trust to specific needs, ensuring assets are properly managed and distributed.

What Happens if a Trustee Mismanages a Trust?

If a trustee mismanages a trust, beneficiaries have legal recourse, including requesting an accounting of trust activities, petitioning for trustee removal, or suing for breach of fiduciary duty. Courts can intervene to protect beneficiaries and ensure the proper administration of the trust.

Are Trusts Public Records in Texas?

No, trusts remain private documents and do not become part of the public record, unlike wills that go through probate. This privacy feature makes trusts an attractive estate planning tool for individuals who want to keep financial matters confidential.

How Does a Living Trust Work in Texas?

A living trust is established during the grantor’s lifetime to manage assets efficiently and ensure a smooth transition upon death. It allows the grantor to retain control while alive and seamlessly transfers assets to beneficiaries without probate upon their passing.

What Is the Difference Between a Revocable and Irrevocable Trust?

A revocable trust allows the grantor to modify, amend, or revoke it at any time, providing flexibility. An irrevocable trust, once established, cannot be changed easily but offers significant benefits like asset protection and tax advantages. The choice depends on estate planning objectives.

Read more:

Darlene Gayman Jennings – A Woman of Faith, Family, and Service https://speedyshortt.com/darlene-gayman-jennings/

Can a Trust Own a Business in Texas?

Yes, a trust can own a business in Texas, making it a valuable tool for business succession planning. Placing a business in a trust ensures continuity, protects assets from personal liabilities, and facilitates smooth ownership transfer to designated heirs or beneficiaries.

How Are Trust Disputes Resolved in Texas?

Trust disputes can be resolved through mediation, arbitration, or court proceedings if necessary. Common disputes involve trustee misconduct, beneficiary disagreements, or mismanagement of assets. Seeking legal counsel can help navigate complex trust litigation effectively.

Does a Trust Avoid Medicaid Recovery in Texas?

A properly structured irrevocable trust can help protect assets from Medicaid recovery, ensuring they are preserved for heirs instead of being used to pay for long-term care costs. However, Medicaid rules are complex, and legal guidance is recommended.

FAQS

1. What makes Wagner Bloomberg unique in trust management?

Their expertise in Texas trust laws and customized strategies ensure effective asset protection.

2. How much does it cost to set up a trust in Texas?

Costs vary based on complexity but typically range from a few hundred to several thousand dollars.

3. Can I change beneficiaries in a trust?

Yes, in a revocable trust; no, in an irrevocable trust unless permitted by its terms.

4. Is a trust better for avoiding probate in Texas?

Yes, trusts help avoid the lengthy and costly probate process.

5. Can a trust be contested in Texas?

Yes, but only under specific legal grounds like fraud or undue influence.

6. Who should consider a trust in Texas?

Individuals with significant assets, business owners, or those with specific inheritance goals.

7. Do I still need a will if I have a trust?

Yes, a will covers assets not placed in the trust and can provide additional instructions.

8. What happens if I move to another state?

Your trust remains valid, but reviewing it with an attorney is recommended.

9. Are trusts revocable after the grantor’s death?

No, they become irrevocable upon the grantor’s death.

10. How do I choose the right type of trust?

Consulting a legal expert, such as Wagner Bloomberg, ensures the best structure for your needs.

Conclusion

Trusts play a vital role in estate planning, asset protection, and financial security, especially under Texas laws.Wagner Bloomberg offers specialized trust services that cater to individual and business needs.

Their expertise ensures compliance with Texas regulations while maximizing financial benefits. Whether you are securing your assets for future generations or optimizing your estate plan, selecting the right trust is crucial.

Understanding the different trust types, their benefits, and their legal implications helps in making informed decisions. With the right guidance, trusts can provide long-term financial security and peace of mind.