Effective tax planning allows you to minimize the total amount paid to the state and federal governments while remaining compliant with tax laws. The process involves strategies such as claiming credits and deductions to reduce your tax liability. Whether you’re an employee or a business owner, working with a wealth planner will help you optimize your taxes. Here are some tax planning solutions available for individuals and businesses:

Custom Individual Tax Strategies

Tax planners offer custom strategies to assist you with meeting your financial goals. Your wealth planner can prepare tax returns, perform audits, and estimate quarterly payments. This makes sure you stay compliant with tax regulations while optimizing your financial outcomes. They also suggest withholdings, calculate distribution, and help with foreign tax reporting. Whether you need to maximize retirement contributions or increase catch-up contributions, tax planners have the knowledge to facilitate your ambition. They offer insight into 401k, IRA, Roth IRA, and other tax-advantaged accounts. You can also get assistance with understanding various credits, from child tax credits to energy-efficient home improvement specials involving renewable sources like solar. Credits and deductions may reduce your annual tax burden.

Wealth planners can help with estate and gift tax return preparation, as well as wealth transfer consulting. Such services enable you to minimize your tax liability as much as possible. Tax planners also provide guidance on charitable contribution planning, including making donations to charities and maintaining accurate records. They can help you use tax losses to offset gains while verifying compliance with regulations to avoid penalties.

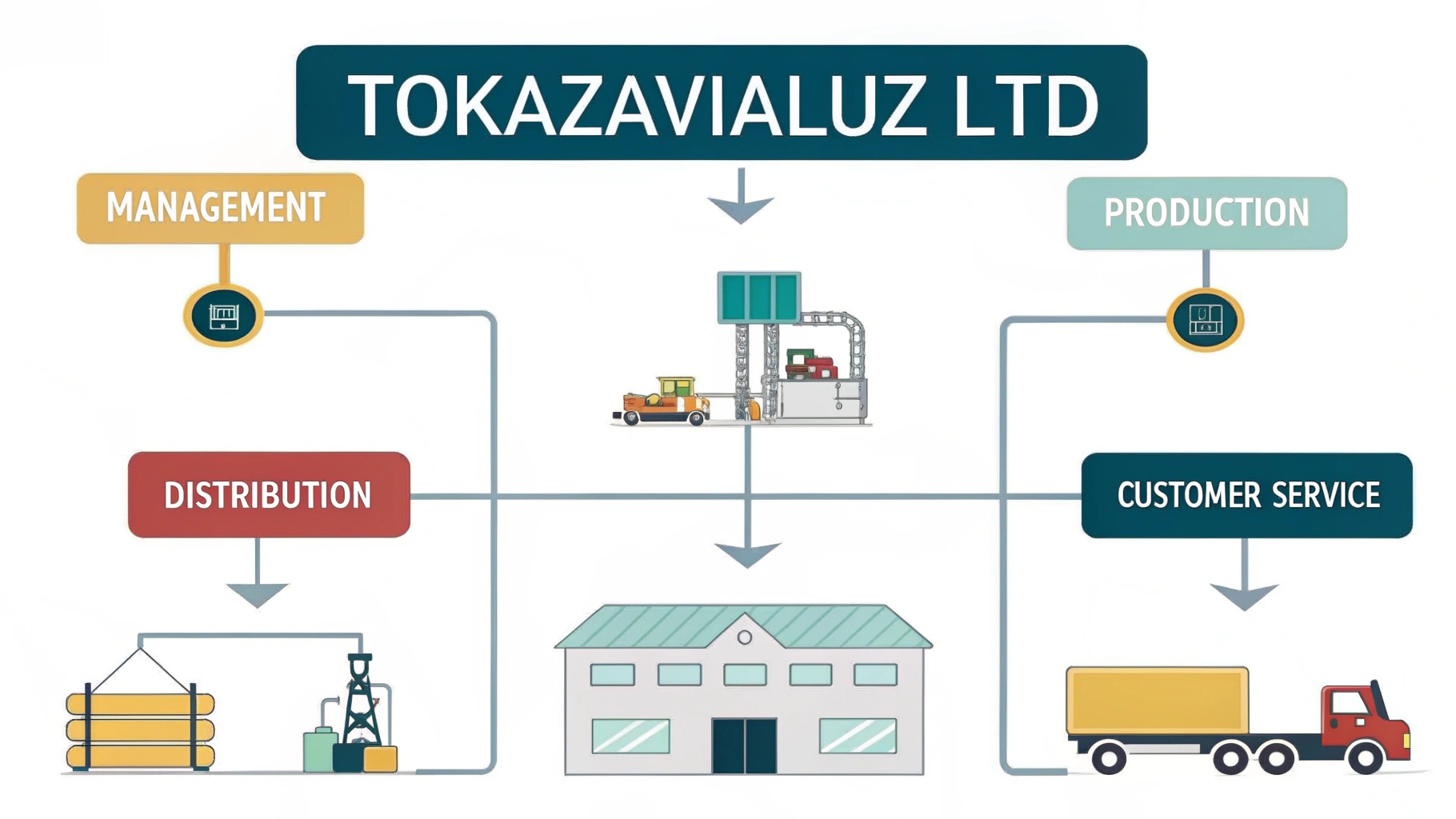

Business Tax Optimization

Tax planning solutions for businesses aim to optimize your taxes by identifying savings opportunities and avoiding compliance-related penalties. Tax planners can help you uncover deductions and credits that lead to significant savings. They also provide guidance on health savings accounts for high-deductible health plans. Such contributions are tax-deductible and feature tax-free growth and withdrawals for medical expenses. Professional planners handle various types of business taxes, including those for S-Corps, LLCs, partnerships, and sole proprietorships. They also assist with partnership allocations, entity type recommendations, audits, and the setup and maintenance of both state and federal tax requirements.

Hiring professionals allows you to choose the right business structure and tax benefits for your situation. They can guide you in claiming deductions for expenses like salaries, rent, utilities, office supplies, and professional services. Tax planners offer assistance with equipment and software deductions and credits, such as R&D tax credits, energy-efficient property incentives, and work opportunity credits. Additional benefits include deferring taxable income through cash-based accounting, setting up 401k and IRA plans for employees, and reducing overall taxable income. Tax planners can also help with home office deductions, including mortgage interest and utilities.

Retirement and Investment Planning

Tax planners can help you identify suitable pension plans that offer tax-deductible contributions to reduce your taxable income. Retirement and investment tax planning enables you to make informed decisions, minimize tax implications, and maintain your standard of living in later years. You can also work with experienced financial services to create comprehensive retirement benefits for employees while lowering tax obligations. Pension funds are typically tax-deferred until the funds are accessed, and they may feature tax-free lump sum withdrawals.

Wealth planners will help you choose the right pension and retirement schemes, maximizing employer contributions and timing withdrawals to minimize tax liabilities. They assist with diversifying retirement savings and staying compliant with changing tax laws. Planners can manage property and investment gains by optimizing your tax position and making the most of available trading allowances. They may also help you write off portions of investments against taxable profits.

Speak to a Wealth Planner Today

Tax planning requires experienced financial advisors who understand the regulations and opportunities available. A knowledgeable planner can guide you through your obligations as an employee or business owner, explain the rules, and help reduce your tax liabilities. Consult a wealth planner today to learn more about tax planning solutions.